capital gains tax increase retroactive

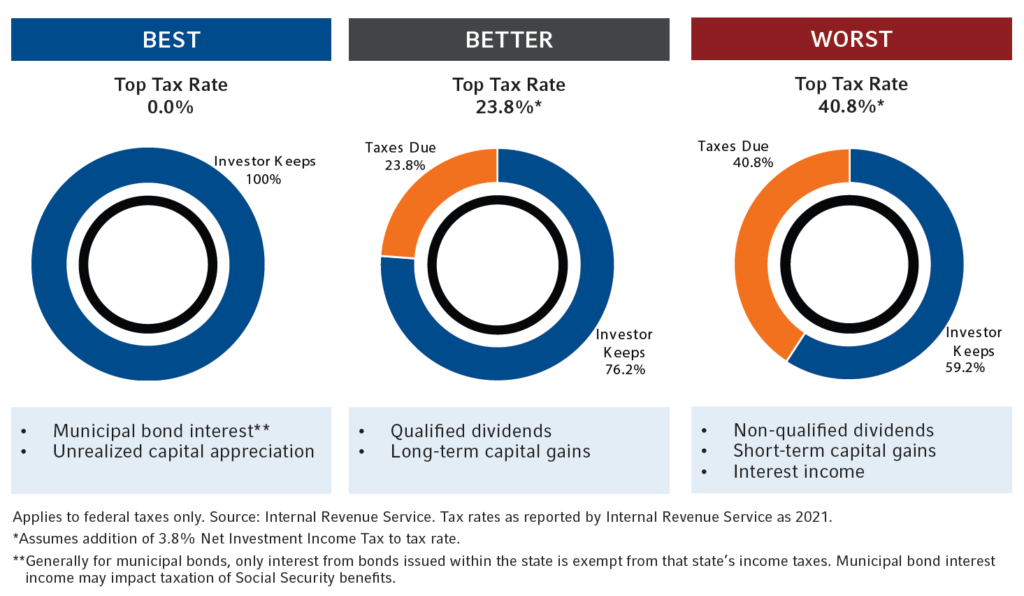

Biden plans to increase the top tax rate on capital gains to 434 from 238 for households with income over 1 million though Congress must OK any hikes and retroactive effective dates the. Get more tips here.

What If Biden S Capital Gains Tax Is Retroactive Morningstar

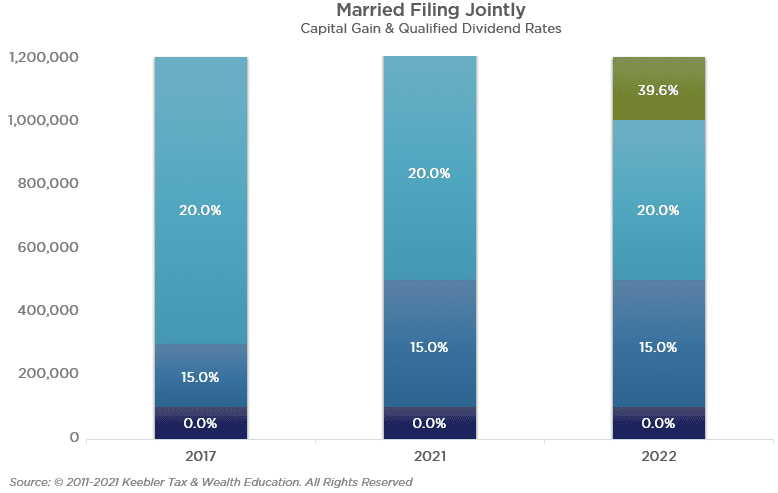

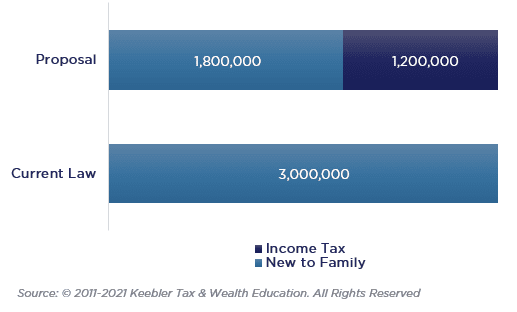

The clients capital gains would be taxed at their ordinary income marginal tax rate which is 37 for 2021 but would rise to 396 in 2022 under the Biden budget plus the.

. Tax bill enacted after the election and assuming a Democratic victory in the. Not only is the Biden administrations plan to make its income-tax increases retroactive bad fiscal. Ad Make Tax-Smart Investing Part of Your Tax Planning.

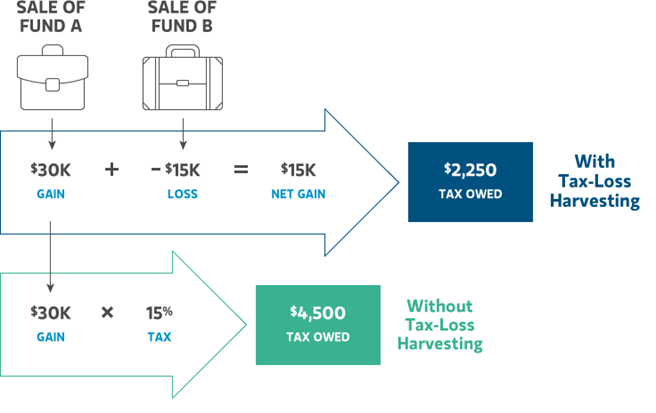

Tax avoidance most of it legal would cut about 900 billion of the estimated 1 trillion that a capital gains tax increase could generate for the federal government over the next. As expected the Presidents proposal would increase the top marginal ordinary income tax rate from 37 to 396 and would apply ordinary income tax rates to capital gains. Browse discover thousands of brands.

As was widely anticipated President Bidens budget calls for some significant changes to the capital gains rules including a proposal to increase the top capital gains rate. This would mean actions taken now. Download 99 Retirement Tips from Fisher Investments.

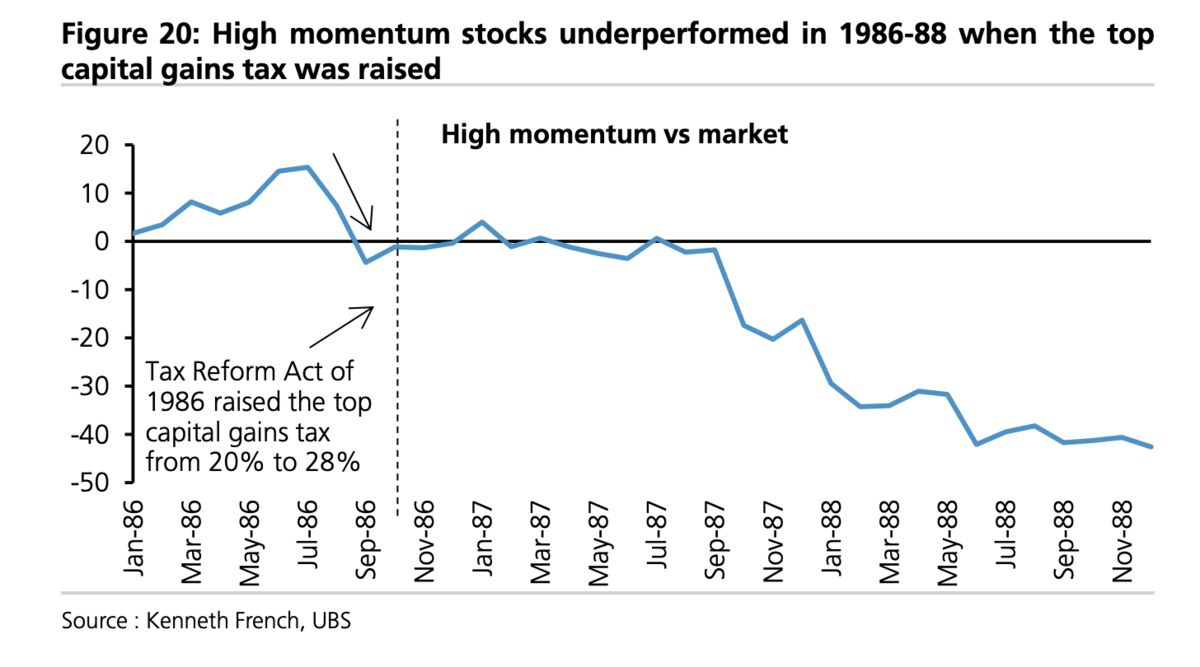

Ad Make Tax-Smart Investing Part of Your Tax Planning. Ad Enjoy low prices on earths biggest selection of books electronics home apparel more. In the Tax Reform Act of 1986 enacted October 22 1986 the tax.

If the effective date is retroactive to April 2021 it will be too late for investors to sell to avoid the tax increase. 2 minutes President Biden really is a class warrior. Ad Tip 40 could help you better understand your retirement income taxes.

The proposed tax increase on capital gains may be applied to taxpayers with annualized realized gains over 1 million with those high net families paying a higher tax rate. There have been two major increases in the tax rate applicable to long-term capital gains in the past 50 years. Whether or not the capital gains tax increase is retroactive the effects on investing and tax planning could be dramatic.

Not only does he want to raise taxes on capital gains to a modern high of 434 he wants to do it retroactively. Connect With a Fidelity Advisor Today. BIDENS PLANNED CAPITALS GAINS TAX HIKE COULD SLASH US REVENUE BY 33B.

Read customer reviews find best sellers. 2 minutes Regarding your editorial A Retroactive Tax Increase May 29. Specifically the Greenbook proposes to tax long-term capital gains and qualified dividends of taxpayers with adjusted gross income of more than 1 million at ordinary.

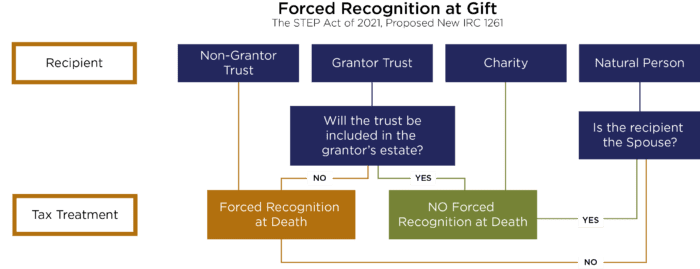

Ad If youre one of the millions of Americans who invested in stocks. Donors will be able to give gifts without realization if the estate provisions take effect after 2021 the. History and Retroactive Capital Gains Rate Changes Conventional wisdom is that any significant US.

Im not freaking out but I cant just put my head in the sand. The proposed budget would increase the taxes on capital gains for Americans earning more than 1 million to 434 which makes the rate the same as these individuals. As was widely anticipated President Bidens budget calls for some significant changes to the capital gains rules including a proposal to increase the top capital gains rate.

Connect With a Fidelity Advisor Today. Equally concerning to the more affluent taxpayers is the possibility that tax increases will be retroactive to the beginning of 2021. Or sold a home this past year you might be wondering how to avoid tax on capital gains.

In order to pay for the sweeping spending plan the president called for nearly. President Joe Biden unveiled a budget proposal Friday calling for a 396 top capital gains tax rate matching previous outlines to help pay for the American Families Plan. Raising the top marginal tax rate on individual income to 396 percent and applying an 8 percent surtax on MAGI above 25 million would bring the combined top marginal tax rate.

President Biden has floated a slew of taxes targeted at the financial industry and high earners including raising the capital-gains tax taxes paid on the value of investments. Appendix Top 2020 marginal tax rates for capital gains and dividends The following table illustrates the current top marginal tax rate on capital gains by provinceterritory as well as.

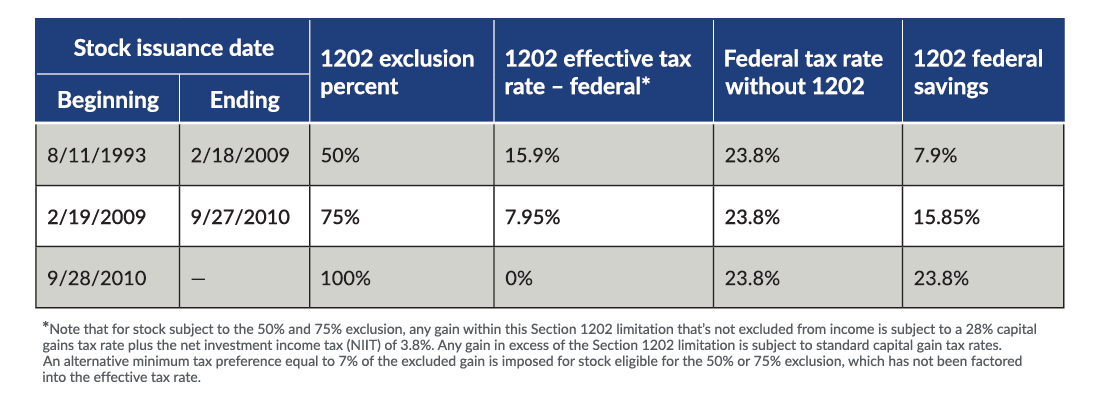

Almost Too Good To Be True The Section 1202 Qualified Small Business Stock Gain Exclusion Our Insights Plante Moran

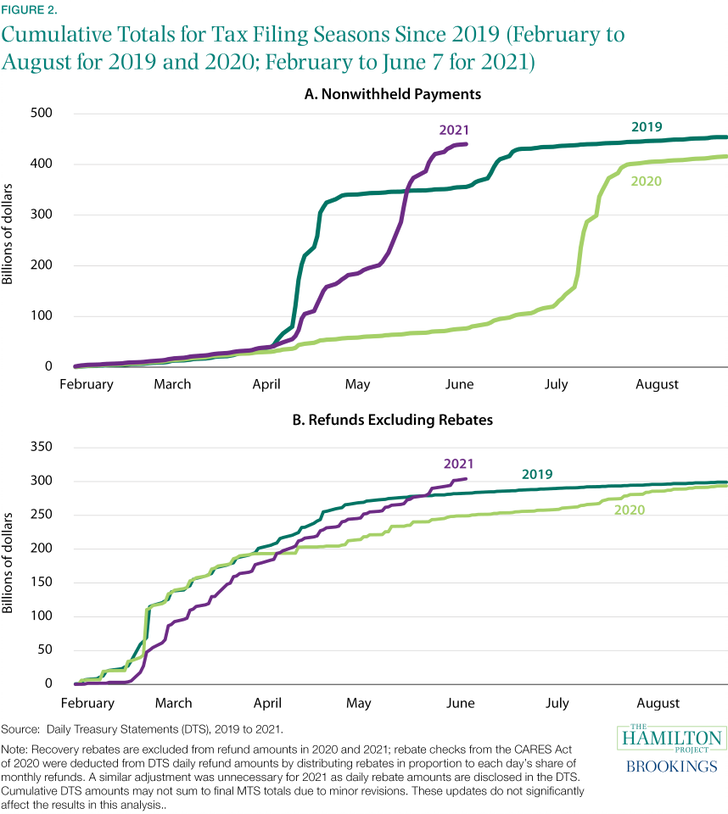

Tax Data Show Evidence Of Strong Income Gains For Higher Income Families And Only Muted Decreases For Lower And Moderate Income Families In 2020 The Hamilton Project

Eye On The Estate Tax Nottingham Advisors

Financial Planning Now In Anticipation Of The Upcoming Election Aaa Cpa

A Higher Capital Gains Tax Wouldn T Be As Scary As It Sounds Barron S

Why This Entrepreneur Wants You To Be A Millionaire

Appmarsh Com On Twitter Personal Finance App Finance App Budget Planner

Fat Valuations And Tech Stocks Seen As At Risk In Biden Tax Plan Bloomberg

Tax Proposals Under The Build Back Better Act Version 2 0

Eye On The Estate Tax Nottingham Advisors

Will Section 529a Plans Replace Special Needs Trusts Financial Advisory Financial Advisors Social Security Benefits

Eye On The Estate Tax Nottingham Advisors

Will Tax Changes Sink The Market Creative Planning

How You Might Prepare For Higher U S Taxes Chase Com

R Rated Top Android App By Best Android App Review Bloomberg Bna S Handy Quick Tax Reference Guide Gives You Access T Medicaid Corporate Law Marketing Jobs

Taxes Archives Cd Wealth Management

Fat Valuations And Tech Stocks Seen As At Risk In Biden Tax Plan Bloomberg